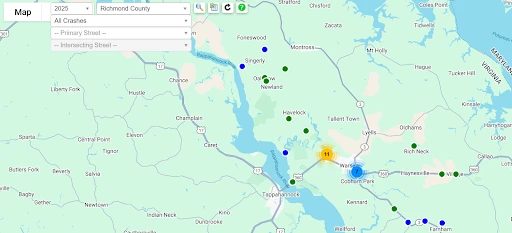

Every year, dozens of drivers and passengers are injured in preventable crashes on Richmond County’s busiest roads. While this Virginia county doesn’t experience the volume of traffic found in nearby metropolitan areas, data from the Virginia DMV’s Traffic Records Electronic Data System (TREDS) reveals persistent patterns. In 2024, there were 87 reported crashes in Richmond County, resulting in 59 injuries, many of which were caused by negligent actions. Below, our Richmond car accident attorneys break down the intersections, corridors, and contributing factors.

Richmond Road × Newland Road: The County’s Most Dangerous Intersection

The intersection of Richmond Road (VA‑360) and Newland Road remains the county’s top crash hotspot, with six crashes and six injuries in 2024. This represents an increase from prior years and reflects the unique risks at this high‑traffic junction. The intersection sits along a heavily traveled stretch of Richmond Road, which connects Warsaw to other parts of the county. Limited sight distance, high approach speeds, and commuter traffic make collisions—particularly angle crashes—more likely here.

Richmond Road × Millpond Road: A Growing Safety Concern

Four crashes and seven injuries were reported at Richmond Road and Millpond Road in 2024, making it the second most dangerous intersection in the county. Although none of the collisions were fatal, the high number of injury crashes suggests issues with turn lanes, visibility, or traffic control.

Richmond Road × Court Circle: Frequent Property‑Damage Crashes

This intersection saw three crashes in 2024. None resulted in injuries, but the repeated incidents suggest confusion among drivers or insufficient controls at the junction. Restricting unsafe driveway connections and clarifying lane use could reduce low‑speed fender‑benders here.

Mid‑Block Crashes Are Widespread

The TREDS data shows that 61% of Richmond County crashes in 2024 happened between intersections. These mid‑block crashes are often linked to:

- Driveway density and poor access management along corridors.

- Speeding on open stretches of road.

- Distraction and driver error.

Corridors like Richmond Road (VA‑360) and History Land Highway had the highest mid‑block crash counts, which mirrors statewide findings on the dangers of uncontrolled access points.

When and Why Do Crashes Happen?

Time of day: Mid‑day (10 am – 4 pm) accounted for 31 crashes, followed by evening (4 – 7 pm) with 20.

Days of the week: Crashes peaked on Fridays and Tuesdays (18 each), with Sunday having the fewest (5).

Contributing factors:

- Speeding: 22 crashes (25% of total)

- Driver distraction: 18 crashes (21%)

- Unrestrained occupants: 12 crashes

- Alcohol impairment: 8 crashes

- Deer collisions: 5 crashes

Enforcement and education efforts targeting speeding and distraction could significantly reduce injury crashes.

Attorney Insight: Using Data to Support Your Case

“Crash history can be a powerful tool in proving liability,” explains attorney Jay Tronfeld. “If a client is injured at an intersection, we use this data to show insurers and juries that the danger was foreseeable. This can help us hold negligent parties accountable, especially when the county or state had prior notice of recurring crashes.”

What You Should Do If You’re Hurt at a High‑Risk Intersection

If you or a loved one are injured at one of Richmond County’s dangerous intersections, the steps you take after the crash matter.

- Document the scene thoroughly, even if police are present.

- Request a copy of the crash report from law enforcement.

- Contact a car accident attorney who understands Virginia’s contributory negligence law and how to use data like TREDS crash records to strengthen your case.

Our team can also determine if roadway conditions or a history of crashes at the site can bolster your claim. Learn more about how we handle cases like yours in a free initial consultation with a Richmond car accident attorney at our law firm.

How a lawyer uses TREDS and intersection evidence for your claim

This isn’t just a list of hot spots. In practice, we use this same DMV dataset to:

- Show a history of similar crashes at the same intersection or corridor segment. That pattern evidence helps explain why a driver should have anticipated turning conflicts or stopping queues.

- Corroborate time‑of‑day and day‑of‑week risk, reinforcing why speed and following distance should be adjusted during known peak windows.

- Tie engineering features (short turn lanes, permissive lefts, sight obstructions) to the way your crash unfolded.

- Counter “low‑impact” arguments by carriers with location‑specific crash trends (e.g., high injury ratios at Millpond and Newland).

FAQs: Richmond County’s Dangerous Intersections

Which intersection saw the most crashes?

Richmond Rd × Newland Rd with 6 crashes and 6 injuries in 2024. This intersection has consistently appeared in crash reports over the past three years, making it a priority location for safety improvements.

What new hotspot appeared in 2024?

Richmond Rd × Millpond Rd registered 4 crashes and 7 injuries, suggesting geometric or visibility issues. This intersection wasn’t among the top crash locations in previous years, indicating a concerning new trend that merits investigation by local transportation officials.

Where did most crashes occur—intersections or mid‑blocks?

Mid‑blocks (53 of 87). That typically signals access‑management and speed‑variance problems on corridors like Richmond Rd and History Land Hwy. This pattern is consistent with rural and suburban roadways where driveways and business entrances create conflict points between high-speed through traffic and turning vehicles.

What were the top driver‑related factors?

Speeding (~25%) and distraction (~21%), followed by unrestrained occupants and alcohol in fewer cases. These human factors are particularly concerning because they’re entirely preventable. Law enforcement campaigns targeting these behaviors could significantly reduce crash rates in Richmond County.

When were crashes most common?

Mid‑day and evenings, and especially on Fridays and Tuesdays. The mid-day crashes (10 am – 4 pm) often correspond with business traffic and errands, while evening crashes (4 – 7 pm) typically involve commuters. The Friday peak aligns with increased weekend travel and potentially fatigued drivers at week’s end.

How do Richmond County crash rates compare to neighboring counties?

Richmond County’s crash rate per capita is slightly lower than neighboring counties, but the injury severity is higher. This suggests that while fewer crashes occur, those that do happen tend to be more serious, possibly due to higher travel speeds on rural roads and longer emergency response times.